In today’s environment, sellers and buyers deserve more - more expertise, more care, and more focus. Dedication to delivering exceptional service is at the core of our commitment to our clients.

We offer a higher level of service and a greater depth of competency than any other real estate organization in Silicon Valley.

We accomplish this by strictly adhering to a few fundamental principles:

Bring in the best people with the strongest education and experience.

Promote teamwork and align incentives with the clients' interests and implement and oversee efficient systems.

10 Steps to buy House

1. Start with your credit: Credit reports are kept by the three major credit agencies, Experian, Equifax, and TransUnion. They show whether you are habitually late with payments and whether you have run into serious credit problems in the past.

2. Set your budget: Next, you need to determine how much house you can afford. You can start with an online calculator.. For a more accurate figure, ask to be pre-approved by a lender, who will look at your income, debt and credit to determine the kind of loan that's in your league.

3. Line up cash: You'll need to come up with cash for your down payment and closing costs. Lenders like to see 20% of the home's price as a down payment. If you can put down more than that, the lender may be willing to approve a larger loan. If you have less, you'll need to find loans that can accommodate you.

4. Find an agent: Most sellers list their homes through an agent -- but those agents work for the seller, not you. They're paid based on a percentage, usually 5 to 7% of the purchase price, so their interest will be in getting you to pay more.

5. Search for a home. Your first step here is to figure out what city or neighborhood you want to live in. Look for signs of economic vitality: a mixture of young families and older couples, low unemployment and good incomes.

6. Make an offer. Once you find the house you want, move quickly to make your bid. If you're working with a buyer's broker, then get advice from him or her on an initial offer. If you're working with a seller's agent, devise the strategy yourself.

7. Enter contract. Have your lawyer or buyers agent review this document to make sure the deal is contingent upon: (1) your obtaining a mortgage. (2) a home inspection that shows no significant defects. (3) a guarantee that you may conduct a walk-through inspection 24 hours before closing.

8. Secure a loan: Now call your mortgage broker or lender and move quickly to agree on terms, if you have not already done so. This is when you decide whether to go with the fixed rate or adjustable rate mortgage and whether to pay points. Expect to pay $50 to $75 for a credit check at this point, and another $150, on average to $300 for an appraisal of the home. Most other fees will be due at the closing.

9. Get an inspection: In addition to the appraisal that the mortgage lender will make of your home, you should hire your own home inspector. An inspection costs about $300, on average, and up to $1,000 for a big job and takes two hours or more.

10. Close the deal. About two days before the actual closing, you will receive a final HUD Settlement Statement from your lender that lists all the charges you can expect to pay at closing.

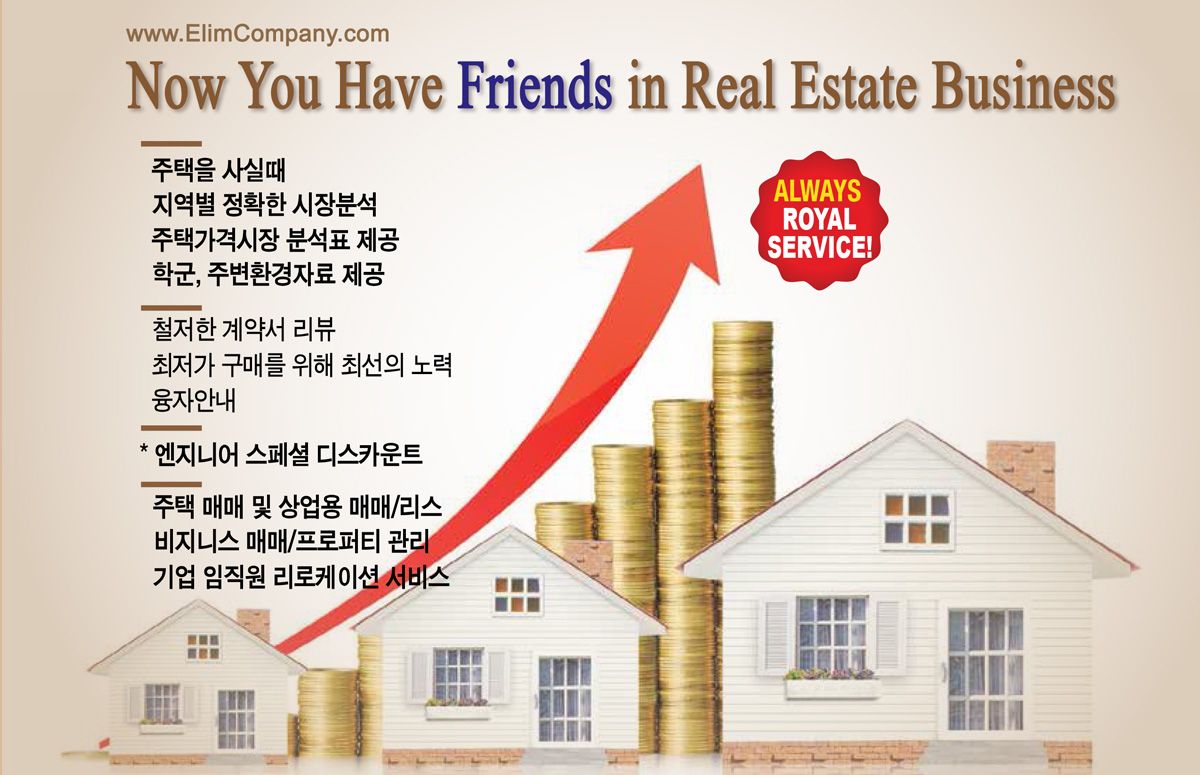

주택을사실때

무료 지역별 정확한 시장분석

무료 주택가격 시장분석표 제공

무료 학군, 주변환경 자료 제공

철저한 계약서 리뷰

최저가 구매를 위해 최선의 노력

융자안내

** 엔지니어스페셜디스카운트